4 maturity levels in the mobility industry

The curious explosion of software in the mobility industry and why it's not about software

First they ignore you. Then they ridicule you. Then they copy you.

That about sums up how traditional manufacturers reacted to Tesla as a phenomena.

From battery technology to mega-casting traditional manufacturers are condemned to poor copies of Tesla as long as they fail to redefine their identity. Although being “software driven” is all the rage, by the end of the decade some brands are gone forever and software is not to blame.

DISCLAIMER: I WORK FOR AN INTERNATIONAL CAR COMPANY. ON MY PERSONAL ACCOUNT I DON'T REPRESENT ANY BRAND OR CORPORATIONS. ALL OPINIONS ARE MINE. THIS IS NOT A DIRECT MESSAGE.

Software

Among all the existential threats facing the traditional car manufacturers, software is a curious one. Not because it’s been my home turf for the past 2 decades but because it is way out of the league of even the most progressive manufacturers.

No, just slapping an iPad on the console doesn’t make a car software driven the same way that taping paper wings to a mouse doesn’t turn it to a bat!

But how do you take a traditional manufacturer and turn it into a software driven company? Well, for starters, you need to own the software as a first class products, a feat that proves more challenging than hiring scarce software talent.

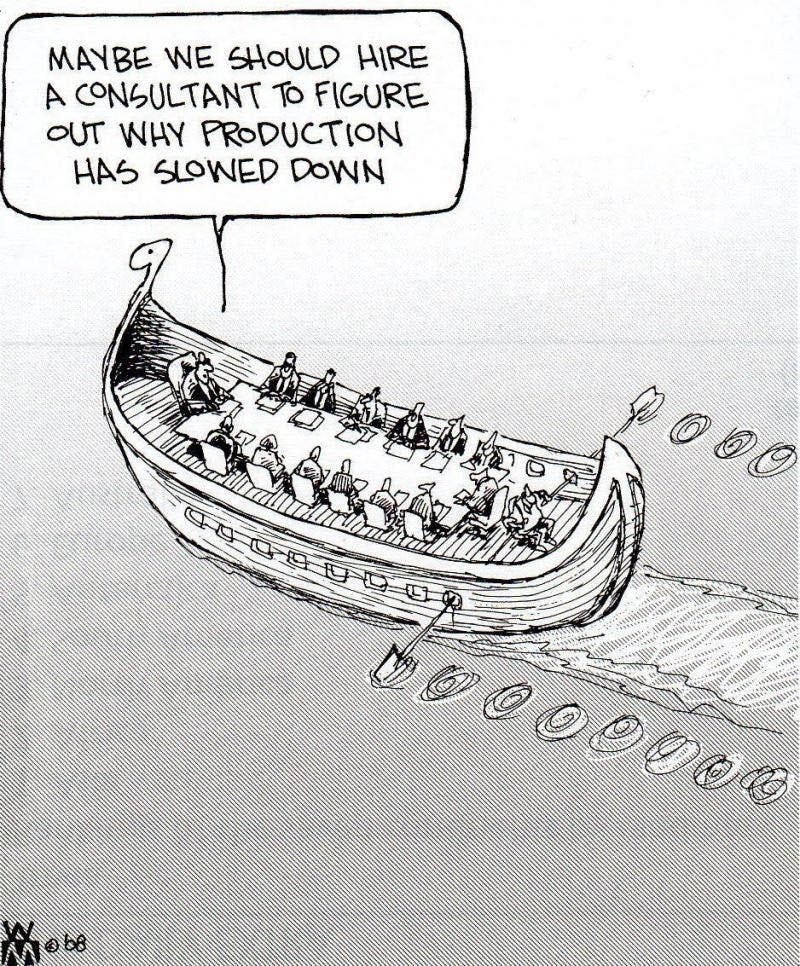

Software is not new to the manufacturing world but for years it was kept at an arm’s length. Car companies traditionally treated software as a mere component: they specified the requirements, then outsourced it to consultants or 3rd parties for a fixed price to be delivered at a set deadline.

That model worked all the way through the “ignore and ridicule Tesla” phase but there was a breaking point where the manufacturers realized that they had to [unwillingly] bring the software in-house. It was primarily motivated by cost saving. It was driven by the realization that:

Software is here to stay, so let’s have a software assembly line with our own software blue-collar workers instead of wasting money on one-off assignments.

Little did they know, there are huge differences between a software product and a physical product like car:

Iterations: Software is developed iteratively and deployed cheaply. The mainstream software industry lives by one mantra: ship early, deploy small and release often. Cars traditionally relied on a waterfall design, test, build and sell cycle. Iterations get exponentially more expensive in the latter phases. Development is secretive and deployment is ceremonial.

Product lifecycle: Software is perfected over time. Cars traditionally don’t change much once they leave the factory door. The average car lifespan is 8 years while software can easily age decades (eg. Linux kernel, Autocad, your company’s payroll system!). Both car and software need maintanance over theit lifespan but the nature of care is entirely different.

Skillset: There are many software practitioners who have little to no academic education in the field. The software industry moves so fast, one has to rely on continuous learning and unlearning to stay in the game. The mechanical, material and electronic engineering that goes into the cars although changing, is bound by the limits of physics (not thoughts) and enjoys a relatively stable pace.

Assembly line: Software engineers are arguably productive working from anywhere. It’s about work getting done, not where it is done. Designing and developing physical products limits where the work can be done. Blanket rules fail to cover a mixed workforce involving software developers and blue-collars.

There’s more, but you get the idea!

As a result, the “car people” and “software people” suffer from deep communication and mutual understanding issues. At best they see each other as dumb monkeys and at worse as threats.

Cost center

The customer demand, industry trends and innovations all point to software being at the core of the modern car experience. Broadly speaking there are two types of software:

Onboard: infotainment, autonomous drive, control units (breaks, door, motor, etc.)...

Offboard: remote phone connectivity, direct to consumer channels, service booking, fleet management, inventory management...

They both shape the holistic customers experience of the car.

Optimize for cost and the product will be cheap. Optimize for value and the product will be worth it.

Software is not seen as a cost center at any car company worth their salt. Calling it a cost center assumes that the real value is somewhere else. Software defines how the car is discovered, configured, purchased/borrowed, onboarded, controlled, driven, charged, repaired and even recycled.

It’s an entirely different beast than anything travelled on the conveyor belts and assembly lines. It is not as tangible as the sexy clay models at the design studios but it’s by no means going away. Conversely, the companies which don’t get it may go away.

👉 Gergely Orosz has an interesting piece on profit center vs cost center which I don’t duplicate here.

“IT”

Referring to the software division of a car company as "IT" screams lack of understanding about the distinction between those roles. I wouldn’t go as far as calling it an insult but IT at a software company has a very specific (admittedly critical) role. From provisioning equipments like phone and computers to access cards and 3rd party vendor contracts, IT provides the space that allows the software folks to get sh*t done.

The actual sh*t is created by an entirely different class of workers with different skills, concerns and backlogs. On the surface we’re all “computer guys” but there are big and small differences between the products, costs and how the daily job looks like. I beg to differ!

Pigeonholing everyone who touches software into the “IT” category is as dumb as classifying everyone who touches car as “car guy” regardless of their role in designing, assembling, selling or repairing the car!

The craft

Software does not replace the car, but rather completes its experience. If we think about maturity levels, you need a solid car product before even beginning to talk about software.

Do you want to know a dirty secret about software? Software is commoditized for the most part thanks to open source. I hold a BSc in hardware and MSc in software system engineering. I spent years learning about algorithms and circuit design yet use none of that knowledge on a daily basis.

By and large the art of software development has changed from writing individual algorithms to the craft of combining pre-written pieces of code and gluing them together.

This is facilitated by package managers and websites like GitHub and StackOverflow! Yes, it’s true! 🤭We get paid to build a solution based off of other people’s work but that part is free.

Knowing what to use and where to use it are the key skills that define modern software engineering. This story can put things into perspective:

A giant engine in a factory failed. The factory owners had spoken to several ‘experts’ but none of them could show the owners how they could solve the problem.

Eventually the owners brought in an old man who had been fixing engines for many years.

After inspecting the huge engine for a minute or two, the old man pulled a hammer out of his tool bag and gently tapped on the engine. Immediately the engine sprung back into life.

A week later, the owners of the business received an invoice from the old man for $1,000. Flabbergasted, they wrote to the old man asking him to send the bill.

The man replied with a bill that said:

Use of a hammer: $1.00

Knowing where to tap: $999.00

Data

Software alone is not the secret sauce. Data is the next layer. A solid software platform enables gathering, injesting and processing data to extract wisdom from customer behavior, feedback, telemetry, operations, etc.

Average car companies aim to be software driven. Great car companies aim to be data driven.

Personalization is usually the main value proposition for the customers to share their data and this puts IAM (identity & access management) at the core of any software platform.

Companies like Uber, Google, AirBnB and Tesla built an empire on top of data. It is used for anything from DDD (data driven decision making) to training ML (machine learning) models which scale the outcomes beyond what is humanly possible.

On the topic of data maturity, the AI academy defines 5 levels based on tooling, skills, collaboration, quality, governance, access and how the raw data is converted to insights driving the strategy.

There is a big world beyond databases and data warehouse that enables reaping value from data. The data products evolve hand in hand with the underlying software products.

Mobility

Only the companies which have a solid car, software and data can start to talk about mobility meaningfully. At that point, the car is merely the base layer for solving mobility —one of many possibilities. The identity of the company evolves from a car manufacturer to a mobility provider.

From cutting the cost of ownership/transportation and reducing the BOM (bill of material) to last mile delivery, robotaxis, and fully autonomous truck fleets, there are many large-scale problems that the humble personal car cannot solve. For a mobility provider, the shape and form of the vehicle is a function of its utility.

Just like Apple created a new market segment with iPhone and iPad, the future of mobility holds many new solutions yet to be realized. To get there, quality data is needed from customers, vehicles and the market. Connecting these dots is not new to any successful manufacturer but the scale, speed and tooling are entirely different ballgame.

Recap

When it comes to the maturity levels, most car companies fall somewhere in this spectrum:

Vehicle driven: These companies define their identity as car manufacturers. Their focus is on the quality/cost equation and at best provide a platform for the next group. They fall short in having a first class software product. Most of their software usage fits into the category of design, manufacturing, inventory and sales. There’s no tech strategy in place to close the gap between the solution soup that’s accomulated over the years from 3rd parties, consultants and in-house development.

Software driven: These companies have a good vehicle product as well as first class software products to provide an integrated onboard and offboard experience. They have a seamless integration and interaction between the hardware and software. When it comes to data, they fall short in collecting and relating data in an effective and meaningful way that drives all aspects of their product creation. The main challenge for these companies is nailing a good holistic CX (Customer Experience).

Data driven: They have a good software product and use their car+software stack to collect a wealth of data which feeds their growth engine. They are on top of how their products are created and used but fall short in using that data to unlock new segments that is drastically different from their origin as a car company. The main challenge for these companies is to reduce the time it takes to turn raw data into high quality and actionable insights and embedding that insight to the product strategy.

Mobility driven: These companies use all sorts of data, correlate them and have a forward thinking strategy to create entirely new market segments (eg. robotaxis, delivery bots, self-driving bikes!). The main focus for these companies is to find the product/market fit, productionalizing and monetization.

The higher you go, the less competition there is and exponentially more impactful problems to be solved. This translates to more revenue which feeds R&D and growth.

Of course everyone wants to aim for the ultimate, but you gotta look inwards to see the talent you got in-house because when it comes to strategy, culture gotta have its breakfast (Peter Drucker didn’t say that BTW).

Talent & mentality

Car industry is not alone! From home appliances to surveillance and media, many business sectors struggle with the “digital transformation”. Software is eating the world not because it is hungry, but because we as species are hungry to improve our life experience. Software exponentially satisfies that desire.

It is said that at one point in human history, we were down to a few thousand individuals. Today we dominate the world. One of the key enablers for our speacie’s survival is our brain’s plasticity which enables us to adapt to the changes in the environment. Our brain hasn’t changed much in the last 100 years while we got cars, airplanes, telephones, computers, smart phones and metaverse!

Nature sets the rules of survival. A companies as a collection of living breathing people is no exception to those rules. Companies can feel stressed and have to adapt and evolve to survive.

From the pandemic to supply chain shortage and war in Europe, companies have gone through a lot. More is on the way due to the recession and rivalry between world’s largest economic powers. Ford, Rivian and Tesla all did layoffs in the past few months. The cheese is moving and has been on the move for some time.

Conclusion

As I get older, I see my own brain slowly but surely having difficulty catching up with change. Hopefully these writings will help me remember how I thought in the past and keep me accountable in the future.

I’d like to close with a tip to the car industry veterans:

Gone are the days when the car was a symbol of prestigue. The world is changing but it’s not about ICE vs EV or cathode vs e-fuel anymore. Nor is it about software vs car.

It is about the sudden change in demands from a new generation who is perfectly capable of satisfying those needs. You have accomulated experience and established a network over the years, but don’t let that title, influence and experience stop the new generation leading the way.

Sometimes the way forward is to step back and unlearn the old to open space for learning the new.

Don’t let your past experiences render you irrelevant. Put the new generation in the driver’s seat and get out of their way. Trust and empower them because if you don’t, some company on the other side of the world will. Don’t ruin a heritage you’re proud of. The best way to predict the future is to give a hand building it.

The mobility industry is too competitive and unforgiving at this time. It leaves very little margin of error for companies which don't get it. By many accounts it is not that different from the smart phone industry of 15 years ago. Speed mattered then, it matters even more now.

If you like this post, please share it. If you have counter arguments, feedback or questions let’s have a dialogue in the comments section 🙌